6 Simple Techniques For San Diego Home Insurance

6 Simple Techniques For San Diego Home Insurance

Blog Article

Obtain the Right Defense for Your Home With Tailored Home Insurance Coverage Insurance Coverage

In a globe where unpredicted conditions can disrupt the harmony of our homes, having the appropriate protection in position is paramount. Customized home insurance coverage uses a safeguard that can give comfort and financial protection in times of dilemma. Browsing the intricacies of insurance coverage policies can be challenging, specifically when attempting to figure out the precise insurance coverage your special home requires. This is where the value of tailoring your insurance policy strategy to fit your specific demands becomes obvious. By comprehending the ins and outs of policy options, protection restrictions, and insurer integrity, you can guarantee that your most considerable financial investment-- your home-- is adequately shielded.

Value of Tailored Home Insurance Coverage

Crafting a personalized home insurance coverage is vital to ensure that your coverage accurately mirrors your private needs and scenarios. A tailored home insurance coverage goes beyond a one-size-fits-all approach, offering you particular security for your distinct circumstance. By functioning very closely with your insurance provider to customize your plan, you can ensure that you are appropriately covered in case of a claim.

Among the key advantages of customized home insurance coverage is that it enables you to consist of insurance coverage for items that are of specific worth to you. Whether you have expensive jewelry, unusual art work, or specific equipment, a customized policy can guarantee that these belongings are safeguarded. In addition, by tailoring your insurance coverage, you can readjust your restrictions and deductibles to line up with your risk resistance and financial capacities.

In addition, a personalized home insurance plan considers factors such as the area of your residential property, its age, and any one-of-a-kind functions it may have. This tailored approach helps to alleviate potential gaps in coverage that can leave you exposed to dangers. Inevitably, spending the moment to tailor your home insurance coverage plan can provide you with comfort recognizing that you have comprehensive protection that satisfies your specific requirements.

Analyzing Your Home Insurance Demands

When considering your home insurance needs, it is vital to examine your specific scenarios and the specific dangers related to your home. Start by analyzing the value of your home and its materials. Consider the place of your building-- is it vulnerable to natural catastrophes like floods, quakes, or typhoons? Examine the criminal offense price in your area and the likelihood of theft or vandalism. Evaluate the age and problem of your home, as older homes might need even more maintenance and can be at a greater danger for problems like plumbing leakages or electrical fires.

By completely reviewing these variables, you can figure out the degree of protection you require to effectively secure your home and possessions. web link Bear in mind, home insurance policy is not one-size-fits-all, so customize your plan to fulfill your particular needs.

Customizing Coverage for Your Building

To customize your home insurance plan properly, it is vital to customize the protection for your certain property and specific demands. When customizing protection for your residential property, take into consideration elements such as the age and building of your home, the value of your items, and any type of distinct functions that might require special insurance coverage. If you own expensive precious jewelry or art work, you might need to include added coverage to protect these products adequately.

Moreover, the area of your property plays a crucial role in personalizing your insurance coverage (San Diego Home Insurance). Residences in locations susceptible to all-natural disasters like floods or quakes might call for extra coverage not included in a standard plan. Recognizing the risks connected with your area can aid you tailor your insurance coverage to reduce potential damages properly

In addition, consider your way of living and personal choices when personalizing your coverage. You might desire to include insurance coverage for theft or vandalism if you frequently take a trip and leave your home empty. By personalizing your home insurance coverage policy to suit your details requirements, you can guarantee that you have the right security in location for your residential property.

Recognizing Plan Options and Purviews

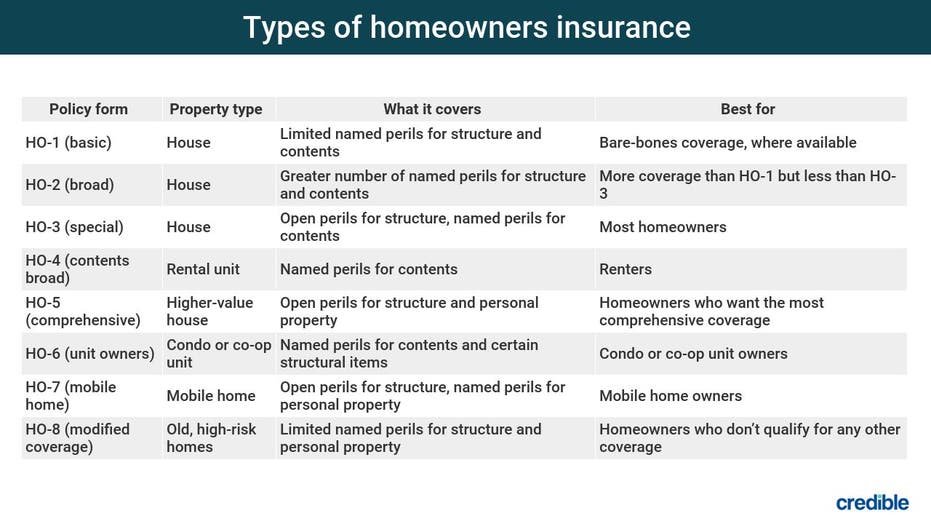

Discovering the numerous plan options and limits is vital for gaining a thorough understanding of your home insurance policy Read Full Report protection. When selecting a home insurance policy, it's necessary to very carefully review the various choices available and guarantee they line up with your certain requirements. Policy options can consist of protection for the structure of your home, personal items, responsibility protection, extra living expenditures, and extra. Recognizing the limits within each of these insurance coverage areas is equally essential. Plan restrictions dictate the optimum amount your insurance policy company will pay out for a protected loss. It's important to assess whether these limitations properly safeguard your assets and responsibilities in case of a claim. Think about elements such as the worth of your home, the expense to replace your individual valuables, and any potential dangers that might call for additional insurance coverage. By closely checking out plan options and limits, you can tailor your home insurance protection to provide the defense you need.

Tips for Selecting the Right Insurance Firm

Comprehending the value of choosing the appropriate insurer is critical when guaranteeing your home insurance policy coverage aligns completely with your requirements and gives the essential security for your assets. check this When choosing an insurance firm for your home insurance coverage plan, take into consideration aspects such as the firm's track record, financial stability, consumer service quality, and insurance coverage options. By complying with these ideas, you can make an informed decision and choose the best insurance company for your home insurance requires.

Verdict

:max_bytes(150000):strip_icc()/dotdash-home-warranty-vs-home-insurance-5081270-Final-b2fa2539ff3c475296bae8529873651f.jpg)

Crafting an individualized home insurance policy is necessary to ensure that your coverage properly shows your individual demands and scenarios (San Diego Home Insurance). Analyze the age and condition of your home, as older homes might require even more upkeep and can be at a greater threat for concerns like plumbing leakages or electric fires

To tailor your home insurance policy efficiently, it is important to tailor the insurance coverage for your particular property and individual demands. When tailoring coverage for your residential property, consider elements such as the age and construction of your home, the value of your items, and any type of one-of-a-kind attributes that might call for unique protection. By very closely checking out plan alternatives and limitations, you can customize your home insurance policy coverage to provide the security you need.

Report this page